Carbon Emission Credits Trading

Emission Credits Trading

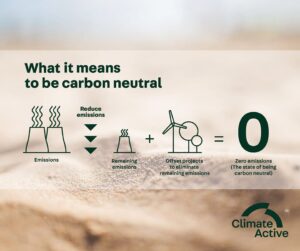

Carbon emission credits trading is the buying and selling of a right to emit a tonne of CO2. The purpose of this form of trading is to provide a financial incentive to reduce emissions. Companies are encouraged to cut emissions through a variety of methods, which range from technological innovations to voluntary offsets.

trade carbon credits are usually categorized into two groups, based on the type of fuel used. Fossil fuels generally produce negative externalities, affecting both companies and third parties. For example, companies that burn coal to generate electricity incur a cost, which is passed on to consumers and other companies. Similarly, if countries burn oil or gas for industrial purposes, they also incur costs.

The market for carbon emission credits is an emerging industry in the United States. Currently, the only state with a cap-and-trade program is California. But, many other countries are considering implementing similar programs. The Paris Agreement, signed by more than 190 countries in 2015, has set national emissions targets, giving the market an additional incentive to reduce emissions. In addition, the Clean Air Act provides the US Environmental Protection Agency with authority to set standards for greenhouse gases under its purview.

Carbon Emission Credits Trading

The European Union Emissions Trading System is regarded as the international benchmark for carbon emissions trading. It allows for the purchase and sale of carbon allowances, which are digitally-held accounts. These allowances are then made available to end users once they are required to meet a regulatory compliance obligation. The amount of carbon allowances issued in a year is based on emissions targets. Depending on the balance between supply and demand, the prices can fluctuate.

In addition to the EU ETS, other carbon markets exist around the world. The Shanghai Environment and Energy Exchange publishes trading information each day, which is then summarised at the end of the day. The information includes the opening price, the average price, the total traded, and the range. The information can be grouped into two categories, spot deliveries and futures exchanges. The spot market offers short-term delivery, while the futures market facilitates longer-dated deliveries.

The Chinese government plans to establish a national carbon emission trading scheme by the end of 2017. The country’s president Xi Jinping has vowed to launch the scheme in 2017. In December 2017, the National Development and Reform Commission released a work plan for the construction of a power sector carbon emission trading scheme.

In China, the Ministry of Ecology and Environment is responsible for regulating the C-ETS and the trading component of the program. During the first week of the program, 4.1 million tonnes of carbon allowances were traded. The ministry published details of the C-ETS trading process and regulations governing its operation. In 2021, the Ministry will introduce a series of rules for MRV (Monitoring, Reporting and Verification). The MRV regulation will require emitters to prepare emission reports, disclose their emissions to the public, and use technical services to verify their emissions.