Why Do Companies Buy Carbon Credit Exchanges?

Buy Carbon Credit Exchanges

The most popular reason is that they can help companies meet their emissions targets, especially those with net-zero goals. Often, a company will find they cannot eliminate all of their emissions by other means. They will also need to offset some of their emissions by purchasing credits that have been generated by other projects. These projects are regulated and must follow strict guidelines in order to be certified and traded.

These requirements include how the project will reduce greenhouse gases (GHGs) and the co-benefits they will generate, such as community economic development or biodiversity protection. The quality of these credits is largely dependent on whether they are certified by a standards organization, usually an NGOs, which must certify that the project meets specific criteria.

Ultimately, a common taxonomy for carbon credit exchange would make it easier for buyers and sellers to match up their needs. It would also improve the quality of credits, reducing risk. Companies that want to buy carbon credits can do so through a variety of methods, such as directly contracting with project developers for delivery of a fixed volume of credits as they are issued, or using an options contract. Typically, they will pay a premium for this kind of deal, but it can also be more cost-effective in some cases.

Why Do Companies Buy Carbon Credit Exchanges?

The demand for carbon credits is growing as more and more businesses set net-zero greenhouse gas emission targets and as countries pursue ambitious climate goals. However, these markets face challenges such as low liquidity, scarce financing and inadequate risk-management services.

Each credit – which is the equivalent of one metric ton of carbon emissions removed, avoided or reduced (CO2e) – represents a reduction in a company’s global carbon footprint. It can be purchased by companies who want to offset their emissions, or it can be used as a financial tool to fund climate-change action.

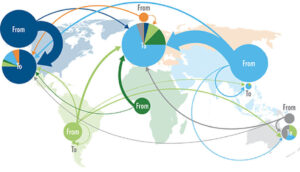

Voluntary carbon markets are a key mechanism for meeting ambitious goals for reducing greenhouse gas emissions. They are largely unrestrained by legal frameworks and can be accessible to a broad range of industries. The voluntary market has a number of stakeholders – from project developers to carbon brokers. Traders buy carbon credits from the suppliers, bundle them into portfolios of hundreds to thousands of equivalent tons of CO2, and then sell them to end buyers. Retail traders, who purchase and sell carbon credits directly to end buyers, are also involved.

To meet ambitious climate goals, companies need to make substantial efforts to reduce their greenhouse-gas emissions. These efforts can include new energy sources, new technology, and improved operating practices. They can also involve purchasing carbon offsets from projects that have undergone rigorous certification processes, which can help them demonstrate their commitment to limiting global warming to 1.5 degrees Celsius.

The voluntary carbon market currently lacks the liquidity necessary for efficient trading. This is partly because of the heterogeneity of credits, which have many attributes associated with them – such as the type of project or the region where it was carried out. Making the types of credits more uniform would consolidate trading activity and promote liquidity on exchanges.